Author: Dr. Oliver Everling

-

Kreissparkasse Gelnhausen’s Leadership Turmoil Raises Concerns About Transparency and Ratings

The recent and unexpected dismissal of Bernd Jacobs, the former chairman of Kreissparkasse Gelnhausen, has caused significant unrest and uncertainty. Jacobs, who took office in July 2023, was removed less than a year later in April 2024. The lack of information regarding this decision, coupled with the deletion of related online news, has raised many…

-

Moody’s Strong Q1 2024 Performance: Implications for Competing Rating Agencies

Moody’s Corporation’s robust financial results for the first quarter of 2024 have significant implications for the competitive landscape of credit rating agencies. With a 21% surge in overall revenue and a standout 35% increase in revenue from Moody’s Investors Service, the company is setting a brisk pace in an industry that thrives on market perception…

-

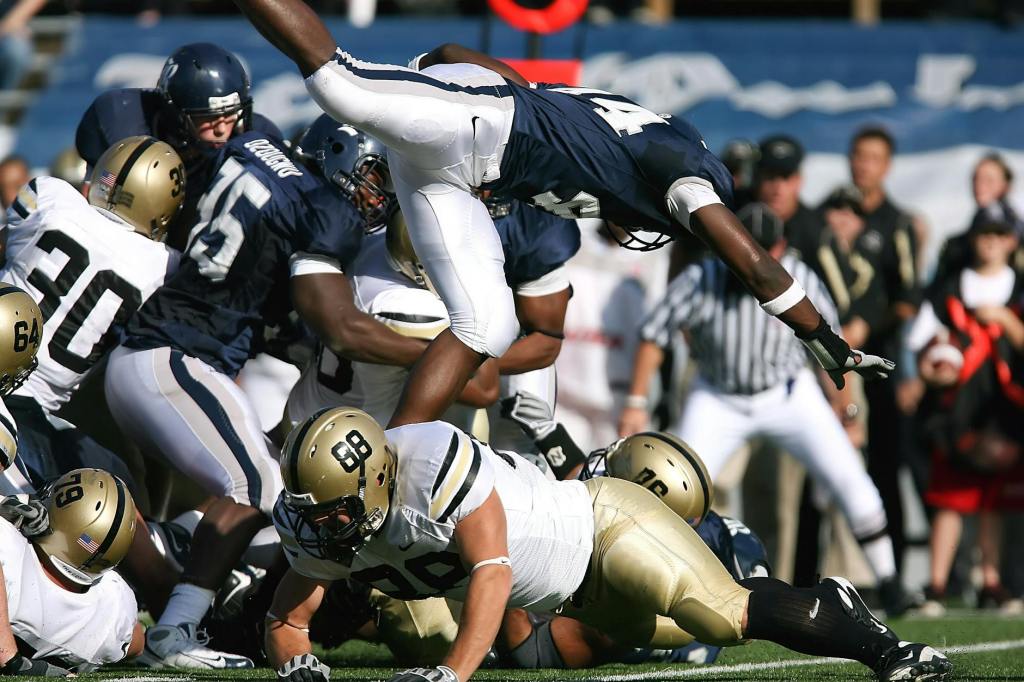

Moody’s Partnership with MetLife Stadium: A Strategic Misstep?

In the realm of corporate partnerships, the recent announcement by Moody’s Corporation to become the Official Cornerstone Partner of MetLife Stadium—home to the New York Giants and New York Jets—has raised several eyebrows. While Moody’s, a leading global provider of credit ratings and risk analysis, positions this as a strategic move aligning with its new…

-

Scope Ratings Affirms KfW’s AAA Rating: A Critical Analysis of Practical Implications

In its latest rating assessment, Scope Ratings has reaffirmed the AAA issuer rating of KfW (Kreditanstalt für Wiederaufbau), Germany’s governmental development bank, with a stable outlook. This decision mirrors the credit stance of its principal backer, the Federal Republic of Germany, which holds a parallel AAA/stable sovereign credit rating. Notably, the reaffirmation applies equally to…

-

The ECB’s Future Agenda: Resilience, Sustainability, and Digital Innovation

ECB’s Supervisory Priorities for 2024-2026: A Vision by Dr. Thomas Gstädtner In the esteemed eff European Finance Forum, Dr. Thomas Gstädtner, Head of Division, DG Micro-Prudential Supervision II at the European Central Bank (ECB), took the stage to elaborate on “The supervisory priorities of the ECB for 2024 to 2026”. With a robust career that…

-

ESMA Fines Scope Ratings Over EUR 2 Million for Conflict of Interest Breaches, Highlighting Need for Timely Regulatory Decisions

The European Securities and Markets Authority (ESMA), the chief regulator and supervisor for the EU’s financial markets, has levied a significant fine of EUR 2,197,500 against Scope Ratings GmbH (Scope) for violating the Credit Rating Agencies Regulation (CRA Regulation). This action stems from Scope’s failure to meet the CRA Regulation’s demands regarding the management of…

-

Morningstar, Inc. Continues to Expand Global Reach and Expertise

Morningstar, Inc., a leading provider of independent financial research and credit ratings, has announced significant milestones in its diverse range of services as of December 31, 2023. In conclusion, Morningstar, Inc. continues to demonstrate its dedication to providing comprehensive financial research and analysis, catering to the evolving needs of investors across the globe. Through its…

-

Moody’s Foundation Expands Global Reach and Community Impact through Strategic Nonprofit Partnerships

Moody’s Foundation, the corporate social investing arm of Moody’s Corporation, has recently announced four new nonprofit partners for the year 2024. This move not only broadens the foundation’s global footprint but also creates opportunities for employees to actively contribute to positive change in their communities. The four new nonprofit organizations joining hands with Moody’s Foundation…

-

Financial Turbulence Surrounds Akelius: Fitch Ratings’ Concerns and Controversial Academedia Stake Acquisition

In the midst of financial turbulence, Akelius Residential Property AB faces scrutiny on multiple fronts. Fitch Ratings recently revised the Outlook on Akelius’s Long-Term Issuer Default Rating (IDR) to Negative, citing concerns about the proposed extra class A dividend and its potential impact on liquidity. This development takes place concurrently with Akelius Foundation’s controversial acquisition…

-

Ensuring Integrity: The Importance of Self-Evaluation for Rating Agencies

Moody’s Corporation has proudly announced that it has received three prestigious recognitions for its sustainable business practices, highlighting its ongoing commitment to environmental, social, and governance (ESG) considerations. As a renowned global integrated risk assessment firm, Moody’s sees sustainability as a fundamental aspect of conducting business and emphasizes the importance of leading by example. In…

-

EU’s ESG Rating Regulation Aims to Challenge Non-European Dominance

The European Union (EU) has recently reached a preliminary agreement between the EU Council and Parliament on the regulation of Environmental, Social, and Governance (ESG) ratings. This move is perceived as an attempt to break the dominance of non-European rating agencies, particularly those based in the United States. While the agreed-upon transparency rules seem to…

-

Morningstar Unveils Enhanced Global Methodology for Prestigious Investing Excellence Awards

Morningstar, Inc., a leading provider of independent investment insights, has announced a comprehensive update to its methodology for the prestigious Morningstar Awards for Investing Excellence. The new methodology, set to be implemented in 24 markets globally, reflects Morningstar’s commitment to recognizing outstanding funds and asset managers that not only deliver strong risk-adjusted returns but also…

-

Critical Assessment of Moody’s Research Assistant

Moody’s Research Assistant, touted as a revolutionary tool in credit analysis, presents a mixed bag of features that warrant a critical examination. While the platform integrates GenAI technology with Moody’s extensive proprietary data, there are several aspects that may raise concerns for users.

-

Morningstar and iCapital Forge Strategic Alliance to Enhance Financial Advisor Access to Alternative Investments and Insights

Morningstar, a leading independent investment insights provider, and iCapital, a global fintech platform empowering the asset and wealth management industry, announced a strategic relationship aimed at expanding financial advisor access to alternative investments and analytics. The collaboration integrates iCapital’s investment technology platform with Morningstar Advisor Workstation, providing over 170,000 financial advisors with unprecedented access to…

-

Moody’s Research Assistant: Revolutionizing Credit Analysis with GenAI

In the ever-evolving landscape of financial markets, staying ahead of challenges and identifying new opportunities is crucial. Moody’s Research Assistant, the latest addition to Moody’s suite of tools, combines cutting-edge GenAI technology with the extensive proprietary data of Moody’s to transform credit analysis for users. Key Benefits: Use Cases: Based on observed usage, Moody’s Research…

-

Challenges in Comparing CRA Market Shares for 2022 and 2021

The landscape of Credit Rating Agency (CRA) market shares for the years 2022 and 2021 presents a complex scenario, marked by challenges in making direct year-on-year comparisons. Several factors contribute to the intricacies of comparing these market shares, and it is crucial to understand these nuances for a comprehensive assessment. In conclusion, the comparison of…

-

Credit Rating Agency UK Market Share Report for 2022: A Closer Look

The Financial Conduct Authority (FCA) recently released its Credit Rating Agency (CRA) Market Share Report for the year 2022, building upon the inaugural report from the previous year. The FCA, in accordance with Regulation (EC) No 1060/2009 and subsequent amendments, oversees UK CRAs to ensure compliance and foster healthy competition within the industry. Regulatory Framework…

-

Deutsche Konsum REIT Faces Further Downgrade After Failing to Impress at Deutsche Börse’s Equity Forum

Deutsche Konsum REIT-AG (DKR), a German commercial real estate company, is grappling with a challenging financial situation, prompting Scope Ratings GmbH to downgrade its issuer rating from BB+/Stable to B. The recent disappointing performance at Deutsche Börse’s equity forum has exacerbated the company’s troubles, and the latest message from Scope further underscores the severity of…

-

Enhancing Venture Capital Investment Evaluation with Morningstar’s New Index Suite

In the fast-evolving landscape of venture capital investment, staying ahead of industry trends is crucial for informed decision-making. Morningstar, Inc., a leading provider of independent investment insights, has recently unveiled the Morningstar® PitchBook Global Unicorn Industry Vertical Indexes™. This suite of eleven indexes is designed to provide enhanced insights into industry trends driving today’s venture…

-

Scope Ratings: Conflicts of Interest Become Apparent from one Day to the Next

The timing of two significant announcements within a span of two days could hardly have been more ill-fated for Scope Ratings GmbH (see Scope Group, The Pitfalls of Close Ties: Examining the Nexus Between Central Banks and Rating Agencies). In conclusion, the juxtaposition of these two announcements within such a short timeframe creates a narrative…

-

KFI Score Insights Tool

In the dynamic landscape of finance, staying ahead of the curve is imperative for making informed decisions. Enter the KBRA Financial Intelligence (KFI) Scores, a groundbreaking quarterly financial assessment tool designed to gauge the health and risk of banks, bank holding companies, and credit unions. This innovative platform has already become a go-to resource for…

-

The Pitfalls of Close Ties: Examining the Nexus Between Central Banks and Rating Agencies

In recent news, the appointment of former governor of the Swedish central bank, Stefan Ingves, to the Honorary Board of the Scope Foundation raises concerns about the potential risks associated with a close relationship between central banks and rating agencies. This development prompts us to explore the intricacies of such connections and their potential implications…

-

Moody’s Strengthens Private Credit Analysis: Implications for Competing Rating Agencies

Moody’s Corporation recently announced a significant organizational change that focuses on the analysis and evaluation of the private credit sector. This move not only has substantial implications for Moody’s itself but also for competing rating agencies and the entire financial industry. In summary, Moody’s announcement signifies a shift in the landscape of rating agencies and…

-

Scope Ratings Introduces New Methodology for Services Companies and Invites Feedback

Scope Ratings, a Berlin credit rating agency, has unveiled its proposal for a Consumer and Business Services Methodology designed to augment its existing General Corporate Rating Methodology. The new framework is tailored for European consumer and business services companies and incorporates a comprehensive array of industry-specific risk drivers. Scope Ratings welcomes comments on the proposed…

-

Moody’s and Google Cloud Partner on Generative AI Applications Tailored for Financial Services Professionals

By working with Google, Moody’s secures unbeatable advantages over other rating providers: New tools will aim to streamline the ability of finance professionals to analyze lengthy financial reports and disclosures using Google Cloud’s generative AI.

-

One of the world’s leading providers of risk and compliance technology

For the second consecutive year, Moody’s has secured the number-one overall ranking in the Chartis RiskTech100® annual report, the most comprehensive study of the world’s leading providers of risk and compliance technology.

-

EU member states face sustained spending pressures

In an analysis by Alvise Lennkh-Yunus and Brian Marly from Sovereign and Public Sector Ratings, it is highlighted that European Union (EU) member states are facing significant fiscal pressures, primarily due to higher interest rates, rising pension and healthcare costs, increased defense spending, and the need for green investments. These pressures are expected to worsen…

-

Launch of Vietnam Investors Service And Credit Rating Agency Joint Stock Company

Moody’s Corporation announced the launch of Vietnam Investors Service And Credit Rating Agency Joint Stock Company (VIS Rating), a partnership between Moody’s and leading Vietnamese financial institutions that was initiated by the Vietnam Bond Market Association (VBMA). Vietnam’s Ministry of Finance issued a credit rating agency license to VIS Rating on September 18, 2023. VIS…

-

Ongoing Availability of Free Weekly Credit Reports

The three Nationwide Credit Reporting Agencies (NCRAs) – Equifax, Experian and TransUnion – are reinforcing their commitment to the financial health of U.S. consumers with the ongoing availability of free weekly credit reports through AnnualCreditReport.com. This free service was first introduced at the onset of the COVID-19 pandemic to help consumers protect their financial health…

-

Scope Ratings’ Failure to Downgrade Ilija Batljan Invest: A Missed Opportunity

Scope Ratings GmbH, a prominent rating agency, recently downgraded Ilija Batljan Invest AB (IB Invest) to CCC/Negative from BB+/under review for a possible downgrade, sparking concerns about the agency’s timeliness in assessing the company’s risks. This downgrade came after a period of the ratings being under review, during which time the company’s financial health deteriorated…

-

Advancing Credit Rating Industry: Dun & Bradstreet and Google Cloud’s Gen AI Collaboration

In a move that holds profound implications for the credit rating industry, Dun & Bradstreet (NYSE: DNB), a globally recognized leader in business decisioning data and analytics, has announced a groundbreaking collaboration with Google Cloud to leverage generative artificial intelligence (gen AI) initiatives. This partnership represents a significant stride forward in the companies’ 10-year strategic…

-

Ordinary Support and Extraordinary Support: Understanding the Distinction

In the realm of financial analysis and risk assessment, the support extended to Government-Related Issuers (GRIs) plays a pivotal role in determining their stability and creditworthiness. This support can be categorized into two main types: ordinary support and extraordinary support. While both forms of support are crucial considerations in evaluating the overall health of a…

-

Scope Affirms A+ Rating for SPIRE Series 2022-308: A Closer Look at the Optimism

Scope Ratings GmbH recently affirmed an A+ rating for Single Platform Investment Repackaging Entity SA’s (SPIRE) Series 2022-308 notes, a EUR 120.9 million issuance of repackaged installment notes of Czech collateral due in 2032. The rating action, conducted on July 27, 2023, highlights Scope’s positive outlook on the credit quality and characteristics of the underlying…

-

Political Risks Cast Shadows on ORF’s Ratings Outlook

Österreichischer Rundfunk Stiftung öffentlichen Rechts (ORF), Austria’s public service broadcaster, has recently received an Outlook revision to Negative from Stable by Scope Ratings GmbH (Scope). While the rating agency has affirmed ORF’s AA long-term issuer and senior unsecured debt ratings, the shift in Outlook reflects the challenges posed by the political risk associated with its…

-

Germans and the Financial Industry: A Lack of Trust

The 2023 Edelman Trust Barometer – Insights for Financial Services reveals areas that are particularly distrusted and those that have surprisingly gained trust.Frankfurt am Main, July 11, 2023 – Trust in the German financial industry is not looking good, as shown by the latest 2023 Edelman Trust Barometer – Insights for Financial Services. Among 17…

-

Moody’s Move to Competitive Advantage

The partnership between Moody’s and Microsoft to develop enhanced risk, data, analytics, research, and collaboration solutions powered by generative AI is likely to influence competition among credit rating agencies in several ways: Overall, the partnership between Moody’s and Microsoft has the potential to enhance Moody’s capabilities in risk analysis, data management, productivity, and collaboration. These…

-

Scope overly optimistic for Corem

A Berlin credit rating agency, Scope Ratings, affirms a BBB- rating of Corem Property Group AB, and revises its Outlook to Negative. The rating affirmation might be considered overly optimistic for the following reasons: In addition, there are the following aspects: Given these factors, the BBB- rating with a Negative Outlook might be considered overly…

-

Strengthened Morningstar’s ESG Offering: Sustainalytics and Indexes Aligned

Morningstar, Inc. has announced that it will align its Morningstar Sustainalytics and Morningstar Indexes product areas under the leadership of Morningstar Indexes President Ron Bundy. This strategic move aims to strengthen Morningstar’s position in the environmental, social, and governance (ESG) market and better cater to the evolving needs of investors. Morningstar is a leading provider…

-

Not sustainable in every sense

The investor protection activist Stefan Loipfinger reveals his concern about the GLS-Crowd, a platform for crowdfunding investments aligned with the sustainable investment and financing principles of GLS Bank. The information provided by Stefan Loipfinger was followed up on RATING©WATCH, see “GLS-BANK Nachhaltig, aber nicht finanziell nachhaltig”, June 9, 2023. Despite the bank’s focus on sustainable…

-

Casino spins

The recent rating action by Scope Ratings GmbH downgraded the issuer ratings of Casino, Guichard-Perrachon S.A. (Casino) and its guaranteed subsidiary Quatrim S.A.S. from B to CC. The ratings are under review for a possible further downgrade. The senior unsecured debt rating was downgraded from B- to C, the senior secured debt rating was downgraded…

-

Scope goes to the upper limit

The Berlin rating agency Scope has affirmed its BB issuer rating and BB rating for senior unsecured debt on JSC Evex Hospitals (Evex) with a Stable Outlook. The affirmation is based on several factors: The Stable Outlook reflects Scope’s expectation of a revenue recovery, the company’s ability to maintain its margins, and the successful transition…

-

Scope Ratings’ appendage methodology

With 16 extensive appendices to only 7 pages of methodology, the new methodology from Scope Ratings sets a new record for imbalance. Scope has updated its covered bond rating methodology, which will now be applied to all covered bond ratings. The update aims to provide further clarity and refinement to Scope’s analytical approach without impacting…

-

Scope Ratings’ Investment Holding Company Rating Methodology

The Berlin rating agency Scope Ratings has published a new rating methodology specifically designed for investment holding companies. This methodology “Investment Holding Companies Rating Methodology – Corporates” has undergone a call-for-comments period and has now been finalized. It will be applied to all issuer and debt ratings of investment holding companies. However, the methodology is…

-

A doubtful future in Sweden

Evolution from stable to negative, as expected (see RATING.REPAIR): Ilija Batljan Invest AB (IB Invest) is a Swedish holding company with a dominant core holding in SBB i Norden. SBB i Norden is a real estate company or an entity involved in real estate investments. The company has recently proposed postponing its dividend payments, leading…

-

Descent as expected

Credit rating agency S&P Global Ratings has downgraded Samhallsbyggnadsbolaget i Norden AB (SBB), a Swedish landlord, to ‘BB+’ from ‘BBB-‘, due to high leverage and tightening liquidity, and assigned a negative outlook. SBB’s committed credit facilities have halved in the first quarter and the company has significant short-term debt maturities of over SEK 14 billion…

-

Scope Downgrades Ilija Batljan Invest AB to BB+/Stable from BBB-/Stable

Ilija Batljan Invest’s deteriorated total cost coverage and increase in leverage, which Scope does not expect to recover in the short-to-medium term, drive the downgrade. It happened the way it had to. Here on RATING.REPAIR, we pointed out two years ago that the rating of this company needs to be repaired. Scope Ratings GmbH (Scope)…

-

-

-

-

-

Misinformation from Silicon Valley Bank

The Silicon Valley Bank deceives investors with excellent credit ratings, which the rating agencies have already withdrawn from the bank: https://ir.svb.com/shareholder-and-bondholder-information/credit-ratings/default.aspx

-

The Banking Renaissance – Renaissance of Conflicts of Interest

Bank buys shares in the rating agency, days later the rating agency recommends bank stocks and bank bonds.

-

-

Good Views Around Sugar Loaf

Equifax Inc. announced a definitive agreement to acquire Boa Vista Serviços, the second largest credit bureau in Brazil.

-

-

-

-

S&P Global’s New Strategic Direction and Growth Targets

S&P Global unveiled today its new strategic direction and growth targets at its 2022 Investor Day in New York. The event is the first Investor Day for the combined Company, following the completion of S&P Global’s merger with IHS Markit earlier this year, and the first for the Company in four years. The Company will…

-

-

-

-

-

-

-

Full Year 2022 Diluted EPS Guidance Range – Adjusted

Moody’s Corporation today announced results for the third quarter of 2022 and updated its outlook for full year 2022. It happened as it had to: While the low interest rate policy resulted in a firework display of bond issues up to the end of 2021, the reluctance of issuers is now becoming noticeable. Inflation with…

-

-

Moral Rating Agency About Russia

A company that wields greater economic Power over Russia has a greater responsibility to take action. Or, put another way, if such a company doesn’t withdraw, it is supporting Russia more than a company with less Power. This is the verdict of a rating agency specializing in these questions.

-

-

Now the Ball is in the Hands of the Credit Rating Agencies

The capital increase and the purchase of the shares by the Federal Government of the Federal Republic of Germany stabilize the company and make it appear less likely that it will run into difficulties. The credit rating agencies must therefore check whether the outlook must remain negative or whether it can even be turned positive.…

-

Local Supply Real Estate in Great Demand – But How to Invest?

A Berlin rating agency is dealing with the far-reaching change in the use of retail real estate: “The local supply sector is one of the winners. Investors appreciate its independence from economic cycles. There are still challenges – sustainability is one of them,” says the research of the Scope Fund Analysis. Scope sees the reason…

-

-

Birth of the Morningstar Medalist Rating

Morningstar to Unite Two Forward-Looking Rating Systems into One.

-

New funds, new top ratings

An impressive 135 portfolios were rated for the first time by the Berlin rating agency Scope, 40 percent of which received a top rating straight away. The rating agency’s analysts were also impressed by many funds with a longer rating history, such as a bond heavyweight from Pimco and an infrastructure stock fund from DWS.…

-

-

A “Security” That Loses 20% in a Single Day

Around 20% fall in the stock market in a single day – that’s the report for Samhallsbyggnadsbolaget I Norden AB Class B shares today, Thursday, July 14, 2022. Stocks with such loss potential can hardly promise the security to warrant an investment grade rating for the investment company holding those stocks. “Scope affirm’s Ilija Batljan…